46% of PE involved deals were reported on by the media before they were publicly announced vs. 32% of those with no PE involvement

PE Leaks and What They Mean for You

Private equity (PE) transactions tend to draw a lot of attention (sometimes even before they are publicly announced), and we have seen scrutiny of the asset class only increase in recent months.

Politicians, regulators, union leaders and the news media are paying closer attention, not just to the household names but also to smaller firms historically only known to PE insiders. There are many reasons for this – some of it is due to the fact that PE is in the business of doing deals (and therefore always on M&A reporters’ radar screens), but also because of rising populist and progressive concerns about all things Wall Street and changing views of the impact of M&A on society, jobs, income inequality, market competition and consumer purchasing power.

This heightened scrutiny has a number of implications for PE dealmaking and, in particular, how firms should incorporate communications planning into their investment processes.

Data from H/Advisors Abernathy’s most recent M&A Leaks Report affirms the intensity of the spotlight on PE; our latest report found that:

59.8 days was the average time between media reports of a PE-involved deal and the transaction’s public announcement vs. 40 days on average for deals that broke in the media prior to public announcement and had no PE involvement

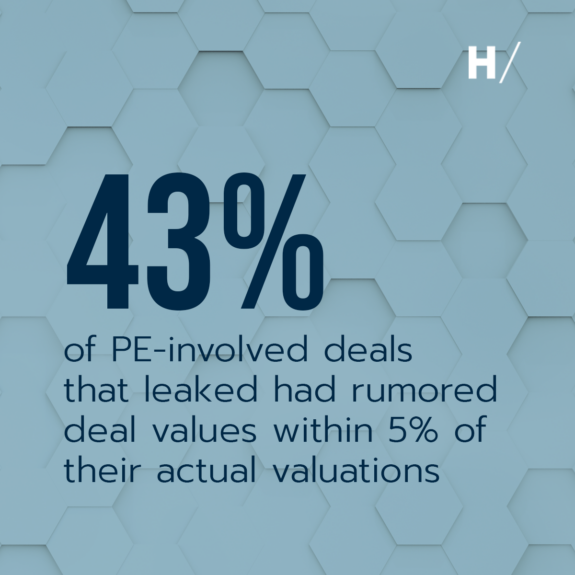

43% of PE-involved deals that leaked had rumored deal values within 5% of their actual valuations vs. 14% of non-PE-involved deals that were scooped

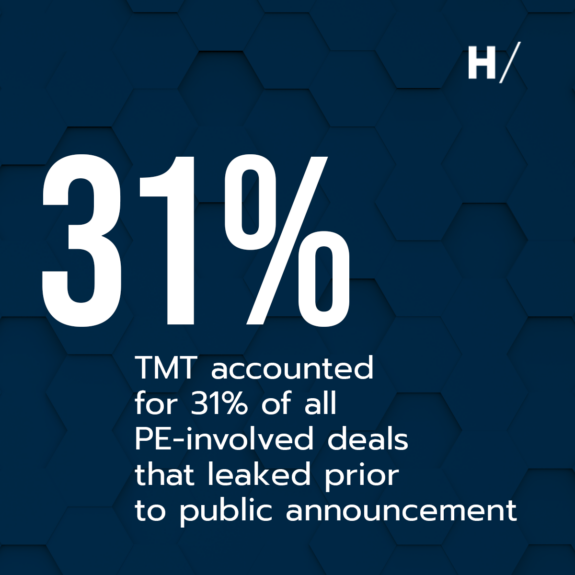

TMT accounted for 31% of all PE-involved deals that leaked prior to public announcement w/Manufacturing, Industrials and Chemicals at 15%, Healthcare and Pharmaceuticals at 15%, and Energy at 12% rounding out the top four industries

What does this mean for PE firms and their portfolio companies working on deals?

Simply put, PE firms should:

- Get Ready. There’s a good chance a reporter is going to break the deal you are working on before you and your counterparty are ready to publicly announce it. As a result, your investment planning needs to factor in whether, how and with which of your stakeholders you are going to communicate if contacted by a reporter, and what level of information you are going to share.

- Be On Your Front Foot. Especially if you are active in politically sensitive sectors like technology and healthcare, remember to always consider how best to control the public narrative about your deal, even if a reporter catches wind of it before you are ready to disclose it. Have a targeted plan, including key messages and stakeholder contact details, at the ready in the event of a premature news leak. Do not let the leak speak for you – if you do, you may miss your chance to convince stakeholders to accept, approve and help make your transaction successful.